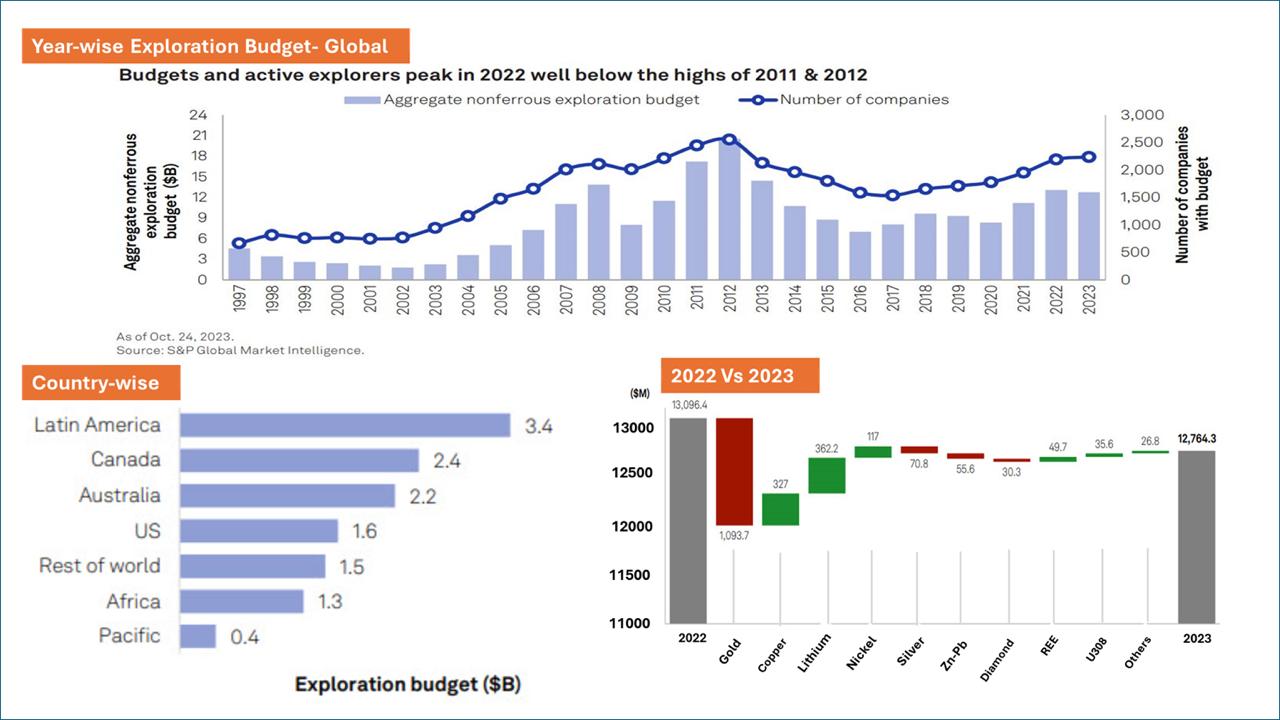

Global Exploration Scenario: Year-wise and Country-wise Budget Insights from 1997 to 2023

- Year-wise Budget on Exploration (1997-2023):

Understanding the trends in budgets over the years provides critical insights into the mining industry’s focus and priorities. From 1997 to 2023, exploration budgets have seen significant fluctuations, with the overall budget peaking in 2012. This peak was driven by a combination of high commodity prices and increased demand for metals, which spurred extensive exploration activities worldwide.

However, in the last decade, there has been a noticeable decline in budgets. Despite the mining sector’s growth and increased expenditures, investment has not kept pace. The reasons for this are multifaceted, including shifts in market conditions, geopolitical uncertainties, and changing investment strategies.

2. Country-wise Budget Allocation:

The budgets vary significantly across different countries, reflecting each nation’s geological potential, regulatory environment, and investment attractiveness. Historically, major mining countries such as Canada, Australia, and the United States have consistently commanded substantial exploration budgets. Emerging markets, particularly in Africa and Latin America, have also attracted considerable investment due to their rich untapped resources.

3. 2022 vs. 2023: A Budget Waterfall Analysis:

closer look at the budget waterfall from 2022 to 2023 reveals some critical trends:

Overall Decline: The year 2023 witnessed a notable decrease in the overall global exploration budget, particularly in gold, which saw a significant dip. This reduction can be attributed to factors such as falling gold prices and investor caution.

Critical and REE Minerals: Despite the decline in gold exploration, there was a slight uptick in budgets allocated to critical and rare earth elements (REE) minerals. However, these increases were insufficient to match the figures from 2022, indicating ongoing challenges in scaling up in these sectors.

Why the Decline in Exploration Budgets Despite Mining Growth?

While mining budgets have increased over the last decade, the exploration sector has not seen parallel growth. Several factors contribute to this discrepancy:

Risk Aversion: Investors and companies have become more risk-averse, focusing on maximizing returns from existing operations rather than investing in new exploration ventures.

Regulatory Challenges: Stricter environmental regulations and permitting challenges in various regions have slowed down exploration activities.

Market Conditions: Volatile commodity prices and economic uncertainty have also played a role in dampening enthusiasm for exploration investments.

The significant dip in gold exploration in 2023 underscores the sensitivity of global exploration budgets to market conditions. While there is cautious optimism in sectors like critical minerals and REEs, the exploration budget has yet to regain its momentum from earlier years.

Understanding these trends is crucial for stakeholders in the mining industry, as they navigate the complex landscape of exploration investment and resource development.

Ref: https://www.spglobal.com/en

Read weekly news on critical and REE updates- https://waartsy.com/weekly-mining-news-11-08-2024/